Monthly Review | World Development under Monopoly Capitalism

Introduction

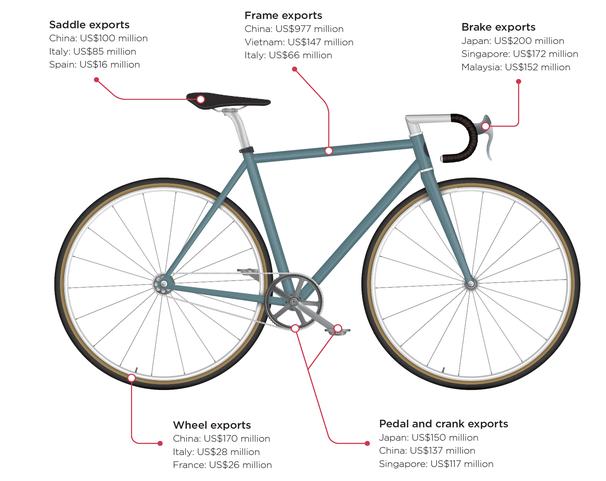

The recent period of globalization—following the collapse of the Eastern bloc and the reintegration of China into the world economy—is one where global value chains have become the dominant organizational form of capitalism. From low to high tech, basic consumer goods to heavy capital equipment, food to services, goods are now produced across many countries, integrated through global value chains. According to the International Labour Organization, between 1995 and 2013 the number of people employed in global value chains rose from 296 to 453 million, amounting to one in five jobs in the global economy.2 We are living in a global value chain world.3

The big question is whether this global value chain world is contributing to, or detracting from, real human development. Is it establishing a more equal, less exploitative, less poverty-ridden world? Which political economic frameworks are best placed to illuminate and explain the workings of this world?

Recent critical scholarship has applied monopoly capital concepts and categories to the analysis of global value chains. John Bellamy Foster and others have illuminated how global value chains represent the latest form of monopoly capital on a world scale.4 John Smith shows how surplus-value transfer and capture—from workers in poorer countries to lead firms in northern countries—is portrayed by mainstream economists as “value added” by those firms.5 Intan Suwandi analyzes how global value chains are enabled by, and also intensify, differential rates of worldwide labor exploitation.6

Mainstream advocates of global value chain-based development tend to ignore such critical analyses, and continue to preach the benefits of global value chain integration by drawing on examples and data that support their claims. However, it says much about the anti-developmental dynamics generated by global value chains when a World Bank report advocating global value chain-based development actually provides data that supports the analyses of the aforementioned critical authors.

Here, we interrogate the data used and the claims made in the World Bank’s World Development Report 2020, titled Trading for Development in the Age of Global Value Chains (WDR2020, or “the report”).7 While the report portrays global value chains as contributing to poor countries’ development through job creation, poverty alleviation, and economic growth, we reveal how its data shows the opposite.8

We also juxtapose comparative advantage trade theory (as deployed in WDR2020 to explain the developmental benefits of global value chain integration) to monopoly capital theory, in order to begin to answer which better illuminates and explains the key developmental dynamics generated by the global value chain world. Comparative advantage trade theory is based on the assumption of arms-length market transactions between firms with no power differentials. The existence of global value chains—where lead firms wield unprecedented economic power over suppliers—invalidates this key assumption. While we are not surprised by the report’s attempts to positively portray global value chain-based development, we are somewhat taken aback by its serious shortcomings, particularly given the intellectual caliber of its authors.

In sum, we provide evidence and theory to support a core claim of the monopoly capital perspective, that “as the internationalisation of monopoly capital grows…the result is a worldwide heightening of the rate of exploitation (and of the degree of monopoly).”9

The World Development Report and the Ideology of Global Value Chains for Development

WDR2020 represents the culmination of almost two decades of pro-global value chain ideological projection. As the former secretary general of the Organisation for Economic Co-operation and Development Ángel Gurría argues: “everyone can benefit from global value chains” and “encouraging the development of and participation in global value chains is the road to more jobs and sustainable growth for our economies.”10 Similarly, the primary position within mainstream academic global value chain analysis is that “development requires linking up with the most significant lead firm in the industry.”11 WDR2020 takes this hyperbole to a new level. According to the report, “participation in global value chains can deliver a double dividend. First, firms are more likely to specialize in the tasks in which they are most productive. Second, firms are able to gain from connections with foreign firms, which pass on the best managerial and technological practices. As a result, countries enjoy faster income growth and falling poverty.”12

According to WDR2020, global value chains are where production takes place in a series of stages, with “at least two stages conducted in different countries.”13 By 2008, 52 percent of world trade occurred under such arrangements (although the growth rate of global value chain trade has stagnated since then, see chart 1). WDR2020 proclaims that “global value chains boost incomes, create better jobs and reduce poverty.”14 Given the World Bank’s promotion of neoliberal globalization, this conclusion is unsurprising. Yet, as the report’s own data shows, such conclusions are unwarranted. In fact, the report almost admits as much itself. Page 106 of the report, citing an OECD study, states how global value chains “have contributed to lower inflation via downward pressures on labor through heightened competition across countries to attract tasks, in particular when low-wage countries are integrated in supply chains.”15

Chart 1. The Growth of Global Value Chain Trade

Source: Reproduced from “Figure 1.2 GVC Trade Grew Rapidly in the 1990s but Stagnated After the 2008 Global Financial Crisis,” in(Washington DC: World Bank, 2020), 19. Creative Commons Attribution CC BY 3.0 IGO.The Fallacies of Comparative Advantage Theory

WDR2020 recognizes that “suppliers are predominantly in developing countries” and “gains may be distributed unequally, even across countries in the value chain.”16 Nevertheless, it reverts to its preferred worldview of comparative advantage trade theory to assert that global value chain-led development generates mutual gains for lead firms (concentrated in developed countries) and supplier firms (concentrated in developing countries). This in turn benefits workers in both rich and poor countries. The so-called comparative advantage of developing countries is their low-cost labor. Accordingly, this perspective shapes its policy recommendations: “Because factor endowments matter, countries should exploit their comparative advantage by eliminating barriers to investment and ensuring that labor is competitively priced, by avoiding overvalued exchange rates and restrictive regulations.”17

The theory of comparative advantage dates back to David Ricardo’s classical argument that countries can benefit from trade even if they do not have an absolute advantage in producing any goods, so long as they specialize in goods in which they have relatively higher productivity. If countries pursue this comparative advantage, then trade generates win-win outcomes whereby every country maximizes its income and enjoys cheaper products.18 Comparative advantage trade theory is a foundational pillar of mainstream development thinking and policy because it promises mutual gains (to trading countries and social classes), through global integration.

The political attractiveness of Ricardo’s theory to advocates of capitalist development—in his day and in ours—is that it naturalizes existing global divisions of labor and capitalist social relations. Every iteration of the theory, as we will argue, is deductive in that it starts from economic assumptions rather than historical experience. For example, Ricardo assumed the existence of a fully globalized world economy in order to make his assumptions about the gains from free trade. Ricardo and his followers also assume the existence of capitalist and laboring classes, and the subordination of the latter to the former, rather than investigating the historical formation of these relations.

Karl Marx, by contrast, explained the historically unique social relations of capitalism as arising out of the co-constitutive processes of mercantile colonialism and so-called “primitive accumulation.”19 Consequently, “capital comes [into the world] dripping from head to foot, from every pore, with blood and dirt.”20

In an ingenious ideological twist, Ricardo argued that relative, rather than absolute, productivity determined gains from trade. This enabled his theory to predict that all countries could gain from trade, rather than only those that were more competitive. This intellectual move legitimated Britain’s incorporation of large swathes of the globe into its imperial-centered division of labor, enabling its advocates to portray such moves as developmentally benign. His classical example (where Britain produced wine and cloth less efficiently than Portugal) painted Britain as the weaker economic power. In reality, Britain had just “liberated” Portugal from Napoleon (in 1808), subordinating it to its own “imperialism of free trade.”21

These tropes—comparative productivities, the benefits of international exchange, the imperial center acting as a benign actor for the benefit of other regions—infused all subsequent theories of comparative advantage.

How Global Value Chain Realities Undermine Comparative Advantage Theory

The deductive basis of comparative advantage trade theory (based on economic assumptions rather than historical evidence) means, however, that it is perilously difficult to apply it accurately to real world conditions. Indeed, models of the theory are only analytically valid under the assumption of “perfect competition,” and are applicable only when market realities broadly adhere to it.

Perfect competition is a scenario in which small price-taking economic actors transact in a competitive market. Because no power imbalances exist, prices merely reflect supply and demand, and liberalized markets ensure a fair distribution of value through arms-length transactions. According to this idealized scenario, suppliers receive a fair price, buyers earn “normal” profits, and workers receive a fair wage.

However, this ideal of perfect competition bears no resemblance to the realities of global value chains (table 1), in which powerful lead firms establish often exclusive relationships with suppliers, dictating all aspects of production and aggressively negotiating prices. Rather, global value chain trade is the antithesis of perfect competition, contradicting the very conditions under which comparative advantage trade theory has validity.

Table 1. Perfect Competition versus Global Value Chain Realities

| Units and Issues of Analysis | Perfect Competition Assumptions | Realities of Relational Global Value Chains |

| Producers | Many producers operate in each industry | A few large “superstar” firms dominate each industry, coordinating many suppliers |

| Counterparties | Anonymous buyers and sellers | Interdependent relationships between lead firms and suppliers |

| Power relations | Equal power between buyers and suppliers | Unequal power wielded by lead firms over suppliers |

| Coordination of transactions | Market forces | Governed by lead firms |

| Prices | Determined by balance of supply of demand | Outcome of unequal bargaining between lead firms and suppliers |

The dominant Heckscher-Ohlin version of the model reformulates comparative advantage on the basis of “factor endowments”—that is, whether a country is relatively “abundant” in either capital or labor. In this model, developed countries are capital abundant and should focus on innovative high-tech production. Conversely, developing states should exploit their advantage in cheap labor with labor-intensive production.22 Poverty alleviation ensues through employment, and national income will be shared between capital and labor, with wages increasing in line with productivity. In this model, factor endowments are assumed to be immobile across borders, despite the evident mobility of capital in the world system (for example, through foreign direct investment). The Stolper-Samuelson version of the model instead defines the two factors as low- and high-skilled labor (rather than capital and labor) (see table 2).

Table 2. Comparative Advantage Trade Theory versus Global Value Chain Realities

| Units and Issues of Analysis | Hecksher-Ohlin Model Assumptions | Realities of Relational Global Value Chains |

| Markets | Perfect competition | (see table 1) |

| Goods traded | Final goods | Intermediate goods |

| Technologies | Both countries have identical technologies | Developed countries protect their superior technologies |

| International factor mobility | Both factors are immobile | Capital is highly mobile, whereas labor is relatively immobile |

| Theorems | Predictions | Realities of Relational Global Value Chains |

| Factor-price equalization theorem | The return to labor relative to capital may fall in developed countries, but should rise in developing countries | The share of income going to labor has fallen in both developed and developing countries |

| Stolper-Samuelson theorem | Inequality between “skilled” and “unskilled” workers may increase in developed countries, but should fall in developing countries | Inequality has increased in both developed and developing countries |

These models of comparative advantage continue to rely on assumptions that are not compatible with the contemporary reality of global value chains—they assume that trade must occur in competitive markets between anonymous parties with equal bargaining power (see tables 1 and 2). For example, WDR2020 references an influential paper by Gene Grossman and Esteban Rossi-Hansburg, which includes the following footnote:

Despite WDR2020’s recognition that global value chain trade is not based on arms-length market transactions, it proceeds to use the language of comparative advantage trade theory to explain the benefits of global value chain participation as trade-related specialization.24 Given this dissonance, however, it should be no surprise that the empirical evidence from global value chain trade does not adhere to predictions derived from models of comparative advantage (see table 2).

Monopoly Capitalism

Modern iterations of comparative advantage theory are based on neoclassical assumptions of perfect competition. Such assumptions exclude the theoretical possibility that unequal power relations among firms enable some to influence others, and capture surplus value from them. Consequently, it is no surprise that the WDR deploys the language of comparative advantage theory in order to portray a global value chain world as largely devoid of fundamentally unequal inter- and intra-firm power relations.

Theories of monopoly capitalism, by contrast, are well placed to illuminate and explain the formation and functioning of a world economy rooted in labor exploitation and unequal power relations between firms. While these theories range from Marxist to non-Marxist political economists, they have in common a rejection of the notion of perfect competition and market equilibrium. As Michał Kalecki, one of the foremost theorists within this broad framework, noted, the assumption of perfect competition is “most unrealistic not only for the present phase of capitalism but even for the so-called competitive capitalist economy of past centuries.… This competition was always in general very imperfect.”25 Joan Robinson argued that perfect competition was a myth and that capitalist competition is characterized by a tendency toward monopolistic competition and thus rising rates of labor exploitation.26

The concept of monopoly capital originates in Marx’s observation that “capital grows in one place to a huge mass in a single hand, because it has in another place been lost by many.” The consequences of this for workers are that “along with the constantly diminishing number of the magnates of capital, who usurp and monopolise all advantages of this process of transformation, grows the mass of misery, oppression, slavery, degradation, exploitation.”27

As part of his analysis of the dynamics of exploitation in production, Marx discusses what happens to surplus value as it is distributed beyond the productive sphere:

Concentration and centralization of capital accelerate and reinforce the transfer of surplus value from weaker to stronger capitals. These dynamics generate tendencies whereby “there is an increase in the minimum amount of individual capital necessary to carry on a business under its normal conditions.”29 As Grace Blakeley points out, “smaller capitalists without large pools of previous earnings crowd into more competitive sectors as they are unable to compete with incumbents in more developed sectors, leaving larger, more established firms with even more market power.”30

Theorists of monopoly capital explained the globalizing dynamics of the postwar years. For example, Paul Baran and Paul Sweezy argued that what multinational corporations wanted was “monopolistic control over foreign sources of supply and foreign markets, enabling them to buy and sell on specially privileged terms, to shift orders from one subsidiary to another, to favor this country or that depending on which has the most advantageous tax, labor, and other policies—in a word, they want to do business on their terms and wherever they choose.”31

But monopoly capital theory does not just focus on the dynamics of capital concentration and centralization. It is also concerned with the balance of power between capital and labor, and how it is institutionally mediated. In his Theory of Economic Dynamics, Kalecki introduced the concept of “the degree of monopoly.”32 This helped him demonstrate how in sectors characterized by higher degrees of monopoly, surplus value would (1) be increasingly centralized in the hands of a few monopolistic firms at the expense of competitive firms, and (2) preside over increased rates of surplus value appropriation (exploitation) from labor. For Kalecki, the degree of monopoly was conjunctural—determined by, among other things, institutional environment and trade union strength.

However, as Malcolm Sawyer argues, such dynamics can also give rise to new opportunities for organized labor, especially when there are large concentrations of workers employed by monopolistic firms.33 Trade unions’ bargaining strategies (as opposed to efforts by isolated and individualized workers) can wrest higher wages from firms, in particular if the latter are in a better position to yield them due to their greater resources. In this dialectical sense, while monopoly capital can lead to higher rates of exploitation, it can also provide opportunities for workers to resist such exploitation. These struggles unfold in historically and contextually specific conditions and their outcomes are always uncertain. Ashok Kumar observes such dynamics in his analysis of workers’ struggles and conflictual capital-labor relations in recently emerged giant suppliers such as Yue Yeun (footwear) in China, Arvind (denim) in India, and Fruit of the Loom (T-shirts) in Honduras.34

These then are two perspectives from which global value chains, and the (anti)developmental dynamics they give rise to, can be viewed. The first is based on assumptions of perfect competition and mutual gains. The second is rooted in an observation of labor exploitation and unequal power relations between firms. Which theory does the WDR’s evidence support? Its authors would like readers to believe that the evidence supports the former, which portrays a world free of power relations and predicts mutual gains for all participants. As we shall see, however, the WDR provides enough evidence to simultaneously undermine its own theoretical vantage point while valorizing the monopoly capital perspective.

WDR2020: Wealth Concentration, Bad Jobs, Wage Repression

The report’s core argument is that “global value chains boost incomes, create better jobs, and reduce poverty.”35 However, the report itself provides enough evidence to suggest that global value chains concentrate wealth, repress incomes, and create many bad jobs (low-wage, low-skill, low-security, and with poor working conditions).

WDR2020 explains that, for its sample of countries, global value chain firms accounted for only about 15 percent of all trading firms, but capture about 80 percent of total trade.36 Following David Autor, David Dorn, Lawrence F. Katz, Christina Patterson, and John Van Reenen, WDR2020 calls the biggest lead firms “superstars.”37 The report further argues that global value chains accelerate development because “relational” global value chain linkages transmit gains from “superstar” lead firms to supplier firms in developing countries and their workers.

It is true that global value chains have ushered in a profit bonanza for lead U.S. firms, who have secured continually rising markups over their costs of production. WDR2020 acknowledges that “global value chains have boosted superstar firms that earn superstar profits and may dominate the market.”38 The report also references Jan De Loecker and Jan Eeckhout’s analysis of the financial accounts of 70,000 firms across 134 countries, which found that profits have risen substantially since 1980, particularly in the United States and Europe, with average markups over costs of production rising from 1.1 to 1.6 by 2016.39

But are these gains mutual or exclusive? De Loecker and Eeckhout find that firms from developing countries have seen markups stagnate or decline, particularly in South America and China.40 WDR2020 is forced to acknowledge that: “Large corporations that outsource parts and tasks to developing countries have seen rising markups and profits, suggesting that a growing share of cost reductions from global value chain participation are not being passed on to consumers. At the same time, markups for the producers in developing countries are declining.”41

In contrast to superstar firms, the report finds that when supplier firms integrate into global value chains, they earn lower markups: “The implications of global value chains for the emergence of superstar firms huge in scale, high in market power, and large in profit rates are exacerbated by the disproportionate bargaining power that these large lead firms may have over their suppliers.… Although buyer firms in developed countries are seeing higher profits, supplier firms in developing countries are getting squeezed.”42

Global Value Chains and the Shift of Income from Labor to Capital

One consequence of intensified lead firm concentration and rising transnational corporation profitability within global value chains is a rising share of national income going to capital rather than labor. De Loecker and Eeckhout find that rising markups of large firms has resulted in an increasing share of income going to capital rather than workers: “Higher markups lead to higher profits, and…they are not driven by higher overhead costs. This further confirms the fact that the increase in markups brings about a distributional change with more of the surplus going to the owners of the firms and less to the workers.”43

As the United Nations Conference on Trade and Development’s Trade and Development Report 2018 puts it: “The rise in the profits of top TNCs [transnational corporations] accounted for more than two thirds of the decline in the global labour income share between 1995 and 2015. Therefore, although the rising share of the profits of top TNCs has come at the expense of smaller enterprises, it has also been strongly correlated with the declining labour income share since the beginning of the new millennium.”44

Faced with this growing consensus, WDR2020 acknowledges that: “In 63 developed and developing economies, global value chain integration as well as other domestic within-industry forces, such as technology or markups, contributed significantly to the reallocation of value added from labor to capital within countries between 1995 and 2011.”45

This has serious implications for the potential of global value chain-led development. Unsurprisingly, given its mutual gains ideology, WDR2020 fails to question whether this might be caused by the impact of global value chains on capital-labor relations. By contrast, Alexander Guschanski and Özlem Onaran include this consideration in their extensive econometric study of developing countries.46 In it, they find that labor’s share of income was negatively impacted by a reduction in workers’ bargaining power following global value chain integration.

What About Workers?

WDR2020 claims that global value chain participation by supplier firms in developing countries can enhance workers’ incomes and livelihoods. The case study of Samsung’s new factories in Vietnam runs throughout the report. Its opening lines gush about Vietnam’s integration into the electronics global value chain: “Samsung makes its mobile phones with parts from 2,500 suppliers across the globe. One country—Vietnam—produces more than a third of those phones, and it has reaped the benefits. The provinces in which the phones are produced, Thai Nguyen and Bac Ninh, have become two of the richest in Vietnam, and poverty there has fallen dramatically as a result.”47

The report ignores Samsung Vietnam’s record of labor rights violations. In 2018, UN inspectors found widespread maltreatment of its mainly female workforce: “Researchers reported testimonies of dizziness or fainting at work from all study participants and high noise levels that violated legal limits. Miscarriages were reported to be common and workers reported pain in their bones, joints, and legs which they attributed to standing at work for 70 to 80 hours a week.”48

The report credits lead firms for implementing “voluntary codes of conduct” that improve working conditions within their supply chains.49 It also celebrates campaigns by benevolent Western consumers and non-governmental organizations. But it veils workers’ own attempts to improve their pay and conditions. For example, it claims that: “In response to demands from international buyers, and learning from international best practices, Bangladeshi producers are increasingly recognizing that they must not only improve their practices, but also ensure that improvements can be independently verified by third parties.”50 Empirically, however, militant strike action was instrumental in securing permanent pay rises in Bangladesh’s global value chains: “Bangladesh’s official wage board has approved a 77% rise in pay for the region’s garment workers from December [2013] after the world’s second largest clothing exporter was crippled by strikes and the Rana Plaza disaster.… In September this year, thousands of garment factory workers in Bangladesh protested over low wage rates, resulting in the closure of many factories.”51

The report’s authors are so unsure of their own arguments that they misconstrue evidence to fortify their claims.

The report’s preferred benchmark is wages and employment: “Not only do global value chain firms employ more people, but they also pay better.”52 However, it presents a highly selective, even misleading, interpretation of the evidence. The report states that “across a sample of developing countries, firms that both export and import pay higher wages than import-only and export-only firms and nontraders.”53 In support, it cites an article by Ben Shepherd and Susan Stone, claiming that their findings show that “firms with the strongest international linkages—export, import, and foreign-owned—pay higher wages.”54

However, the purpose of Shepherd and Stone’s study is to provide “evidence on the links between Global Value Chains and labor markets, focusing on developing economies, particularly the OECD’s Key Partner countries (Brazil, India, Indonesia, China, and South Africa).”55 These countries account for the majority of workers employed in global value chains.56 Shepherd and Stone do find a positive link with wages for a large sample of 108 countries. Crucially, however, when they focus on these five developing economies they find “no discernible impact of international linkages on wage rates in these data for the key partner countries.… The effects of global value chains may be primarily felt in emerging markets through increased employment rates rather than higher wages.”57 In summary, they discern no association between global value chain employment and higher wages in these countries.

Conclusions

Global value chains are the defining organizational feature of contemporary global capitalism. They have integrated new regions into global circuits of accumulation, generated novel opportunities for capitalist profit, and expanded the size of the global working class. These dynamics have been lauded by many commentators as providing innovative development opportunities for poorer world regions. Such arguments are founded, in part, on the theory of comparative advantage, which claims that global integration through trade generates mutual gains for all concerned.

This is the familiar narrative advanced by the World Bank’s Trading for Development in the Age of Global Value Chains, and its headline message that “global value chains boost incomes, create better jobs and reduce poverty.” The only problem is that the report actually provides sufficient evidence to suggest the opposite—that global value chains concentrate wealth, repress incomes, and create many bad jobs. The attempt by the report’s authors to shoehorn the unequal realities of the global value chain world into the pristine deductive logic of comparative advantage theory further compounds the problem, as the report’s evidence also undercuts the assumptions and predictions of the theory.

Monopoly capital theory is better placed to illuminate and decipher the anti-developmental dynamics generated by the global value chain world. The core message of this theoretical perspective, unlike comparative advantage theory, is that workers’ collective action, rather than the dynamics of capitalist expansion, are the key to improvements in workers’ conditions under capitalism.

Notes

- ↩ Joan Robinson,(New York: Macmillan, 1937), 176.

- ↩ International Labour Organization,(Geneva: ILO, 2015).

- ↩ Frederick W. Mayer and Nicola Phillips, “Outsourcing Governance: States and the Politics of a ‘Global Value Chain World,’”22, no. 2 (2017): 134–52.

- ↩ John Bellamy Foster, Robert W. McChesney, and R. Jamil Jonna, “The Internationalization of Monopoly Capital,”63, no. 2 (June 2011): 1.

- ↩ John Smith, “The GDP Illusion,”64, no. 3 (July–August 2012): 86–102.

- ↩ Intan Suwandi,(New York: Monthly Review Press, 2019).

- ↩(Washington DC: World Bank, 2020).

- ↩ Benjamin Selwyn and Dara Leyden, “Oligopoly-Driven Development: The World Bank’s Trading for Development in the Age of Global Value Chains in Perspective,”(2021). For a critique of WDR2020’s methodology, see: Jennifer Bair, Mathew Mahutga, Marion Werner, and Liam Campling, “Capitalist Crisis in the ‘Age of Global Value Chains,’”53, no. 6 (2021): 1253–72

- ↩ Foster, McChesney, Jonna, “The Internationalization of Monopoly Capital,” 12.

- ↩ Quoted in Marion Werner, Jennifer Bair, and Victor Ramiro Fernández, “Linking Up to Development? Global Value Chains and the Making of a Post-Washington Consensus,”45, no. 6 (2014): 1220.

- ↩ Gary Gereffi, “Shifting Governance Structures in Global Commodity Chains, with Special Reference to the Internet,”44, no. 10 (2001): 1622.

- ↩ , xii.

- ↩ , 265.

- ↩ , 3.

- ↩ , 106, emphasis added. See also Dan Andrews, Peter Gal, and William Witheridge, “A Genie in a Bottle? Globalisation, Competition, and Inflation” (OECD Economics Department Working Paper 1462, Document ECO/WKP 10, Organisation for Economic Co-operation and Development, Paris, March 20, 2018).

- ↩ , 141–42.

- ↩ , 161, emphasis added. See also pages 42, 48, 69, 126, 137, 148, 185, 195–96, 202.

- ↩ Mankiw, N. Gregory and Mark P. Taylor, “Macroeconomics: European Edition,” in(New York: Worth Publishers, 2008).

- ↩ Karl Marx, , vol.1. (London: Penguin, 1990); Lucia Pradella, “New Developmentalism and the Origins of Methodological Nationalism,”18, no. 2 (2014): 180–93.

- ↩ Marx, , vol. 1, 871, 926.

- ↩ John Gallagher and Ronald Robinson, “The Imperialism of Free Trade,”6, no. 1 (1953): 1–15.

- ↩ Justin Lin and Ha-Joon Chang, “Should Industrial Policy in Developing Countries Conform to Comparative Advantage or Defy It? A Debate between Justin Lin and Ha-Joon Chang,”27, no. 5 (2009): 483–502.

- ↩ Gene M. Grossman and Esteban Rossi-Hansberg, “Trading Tasks: A Simple Theory of Offshoring,”98, no. 5 (2008): 1983.

- ↩ , 32–34.

- ↩ Michał Kalecki,(CUP Archive, 1971), quoted in Malcolm C. Sawyer, “Theories of Monopoly Capitalism,”2, no. 1 (1988): 47–76.

- ↩ Joan Robinson,(Cambridge: Cambridge University Press, 1979), 313.

- ↩ Marx, , vol. 1, 777, 929.

- ↩ Marx, , vol. 1, 709.

- ↩ Marx, , vol. 1, 777.

- ↩ Grace Blakeley, “The Big Tech Monopolies and the State,”57 (2021): 100.

- ↩ Paul A. Baran and Paul M. Sweezy, Monopoly Capital (New York: Monthly Review Press, 1966), 201.

- ↩ Michał Kalecki,(London: George Allen & Unwin, 1954).

- ↩ Malcolm C. Sawyer, “Theories of Monopoly Capitalism,”2, no. 1 (1988): 47–76.

- ↩ Ashok Kumar,(Cambridge: Cambridge University Press, 2020).

- ↩ , 3.

- ↩ , 30–31.

- ↩ David Autor, David Dorn, Lawrence F. Katz, Christina Patterson, and John Van Reenen, “The Fall of the Labor Share and the Rise of Superstar Firms,”135, no. 2 (2020): 645–709.

- ↩ , 84.

- ↩ Jan De Loecker and Jan Eeckhout, “Global Market Power” (working paper no. w24768, National Bureau of Economic Research, 2018).

- ↩ De Loecker and Eeckhout, “Global Market Power,” 7.

- ↩ , 3, emphasis added.

- ↩ , 85.

- ↩ De Loecker and Eeckhout, “Global Market Power,” 10.

- ↩ UNCTAD,(New York: United Nations, 2018), 57.

- ↩ , 86.

- ↩ Alexander Guschanski and Özlem Onaran, “The Effect of Global Value Chain Participation on the Labour Share—Industry Level Evidence from Emerging Economies” (Greenwich Papers in Political Economy, GPERC82, London, University of Greenwich, 2021).

- ↩ , xi.

- ↩ “Vietnam: UN Experts Concerned by Threats Against Factory Workers and Labour Activists,” United Nations Human Rights, March 20, 2018.

- ↩ , 89.

- ↩ , 67.

- ↩ Lianna Brinded, “Bangladesh Approves 77% Pay Rise for Garment Factory Workers,” , July 1, 2014.

- ↩ , 79.

- ↩ , 80.

- ↩ , 95.

- ↩ Ben Shepherd and Susan Stone, “Global Production Networks and Employment: A Developing Country Perspective” (OECD Trade Policy Paper 154, 2012), 14, 3.

- ↩ Suwandi, , 47.

- ↩ Shepherd and Stone, “Global Production Networks and Employment,” 15.

- Prev

- Next